Imagine having a personal assistant that never sleeps, constantly monitoring the cryptocurrency market and executing trades on your behalf while you enjoy your favorite show. This is now a reality thanks to AI-powered trading bots. By 2025, these bots have revolutionized the way investors interact with the crypto market.

At CoWrit Technologies Inc, we specialize in AI applications and digital solutions. We have witnessed firsthand how artificial intelligence and blockchain technology are transforming the crypto landscape. Our expertise positions us uniquely to guide you through this exciting intersection of technologies.

The convergence of AI and crypto has opened new avenues for investors. With the ability to monitor markets 24/7 and execute trades automatically, investors can now participate in the market more effectively than ever before.

Key Takeaways

- AI-powered trading bots are revolutionizing cryptocurrency trading.

- The integration of AI and blockchain is transforming the crypto landscape.

- Automated trading enables investors to participate in the market without constant monitoring.

- CoWrit Technologies Inc specializes in AI applications and digital solutions.

- The future of crypto trading is heavily influenced by artificial intelligence.

The Future of Cryptocurrency Trading in 2025

Cryptocurrency trading in 2025 is on the cusp of a revolution, driven by technological innovation and market maturity. As we navigate this evolving landscape, it’s clear that the crypto market is becoming increasingly sophisticated.

Market Evolution and Key Trends

The cryptocurrency market in 2025 has evolved significantly, with sophisticated trading mechanisms becoming mainstream for both retail and institutional investors. We’re witnessing unprecedented market maturity, with regulatory frameworks finally catching up to innovation, creating more stable trading environments.

Key trends include the integration of predictive analytics in trading platforms, allowing for more accurate market forecasting and opportunity identification in real-time. This evolution is creating new opportunities for traders and investors alike.

The Role of AI in Transforming Trading Strategies

The role of artificial intelligence in transforming trading strategies has moved from experimental to essential. AI algorithms are now capable of analyzing complex market patterns that would be impossible for human traders to identify. Machine learning models process vast amounts of historical and real-time data to execute trades at optimal moments, significantly reducing human error and emotional decision-making.

These AI-powered systems have democratized sophisticated trading strategies that were once only available to institutional investors, creating new opportunities for individual crypto traders. As a result, traders can now make smart, data-driven decisions, refining their approach before risking any real capital.

Understanding AI-Powered Crypto Trading

AI-powered crypto trading is transforming the landscape of digital asset investment, offering sophisticated tools for market analysis and trading execution. As we explore this evolving field, it’s essential to understand the underlying technologies and their implications for investors.

How Machine Learning Enhances Trading Decisions

Machine learning algorithms form the backbone of modern crypto trading systems, continuously analyzing vast amounts of market data to identify patterns and anomalies that signal potential trading opportunities. These AI models process multiple data streams simultaneously, including price movements, trading volumes, social sentiment, and macroeconomic indicators, to form comprehensive market insights.

The neural networks employed in advanced trading systems can adapt to changing market conditions in real-time, refining their predictive models with each transaction and market shift. This capability enables traders to make more informed decisions, leveraging the power of machine learning to stay ahead in the competitive crypto market.

Advantages and Limitations of Automated Trading Systems

While automated trading systems offer significant advantages like emotion-free execution and 24/7 operation, they also have limitations. For instance, there’s a risk of overfitting to historical data, and these systems can struggle to adapt to unprecedented market events.

To mitigate these risks, it’s crucial to understand how machine learning models are trained, validated, and implemented in crypto trading environments. By doing so, investors can effectively leverage these tools while maintaining appropriate risk management protocols.

| Feature | Advantages | Limitations |

|---|---|---|

| Emotion-free Execution | Reduces impulsive decisions | Lacks human intuition |

| 24/7 Operation | Monitors markets continuously | Requires robust infrastructure |

| Data Analysis | Processes vast data quickly | Risk of overfitting to historical data |

Crypto & Trading in 2025: Top Altcoins, AI-Powered Strategies

As we look towards 2025, the integration of blockchain and artificial intelligence is set to revolutionize the crypto trading landscape. The fusion of these technologies addresses fundamental issues in both fields—decentralizing AI development while providing intelligent automation to crypto networks.

The Convergence of Blockchain and Artificial Intelligence

The convergence of blockchain technology and artificial intelligence represents one of the most significant technological developments in the crypto space. This synergy creates entirely new categories of digital assets and trading mechanisms. Blockchain provides the transparent, immutable infrastructure needed for AI systems to access reliable data, while AI enhances blockchain networks with predictive capabilities and operational efficiency.

We’re seeing the emergence of specialized altcoins that leverage this technological convergence, offering unique value propositions beyond traditional cryptocurrency use cases. These altcoins are part of tokenized AI ecosystems that offer practical solutions for data marketplaces, computing resource allocation, and model governance.

Key Performance Metrics for AI-Enhanced Trading

To evaluate AI-enhanced trading systems, we need to focus on key performance metrics. These include win-rate percentages, drawdown management, risk-adjusted returns, and adaptability to different market conditions. Understanding these metrics is crucial for investors looking to select the most effective AI-powered trading solutions for their portfolios.

| Performance Metric | Description | Importance |

|---|---|---|

| Win-Rate Percentage | Percentage of successful trades | High |

| Drawdown Management | Ability to minimize losses | High |

| Risk-Adjusted Returns | Returns relative to risk taken | Medium |

| Adaptability | Ability to perform in various market conditions | High |

The most successful AI trading strategies in 2025 will demonstrate consistent performance across various market cycles. By understanding and interpreting key performance metrics, investors can make informed decisions about their AI-powered trading solutions.

Top AI-Powered Trading Bots for 2025

With the rapid evolution of cryptocurrency markets, AI-powered trading bots have emerged as essential tools for traders in 2025. These sophisticated platforms offer a range of strategies and automation capabilities that can significantly enhance trading efficiency and performance.

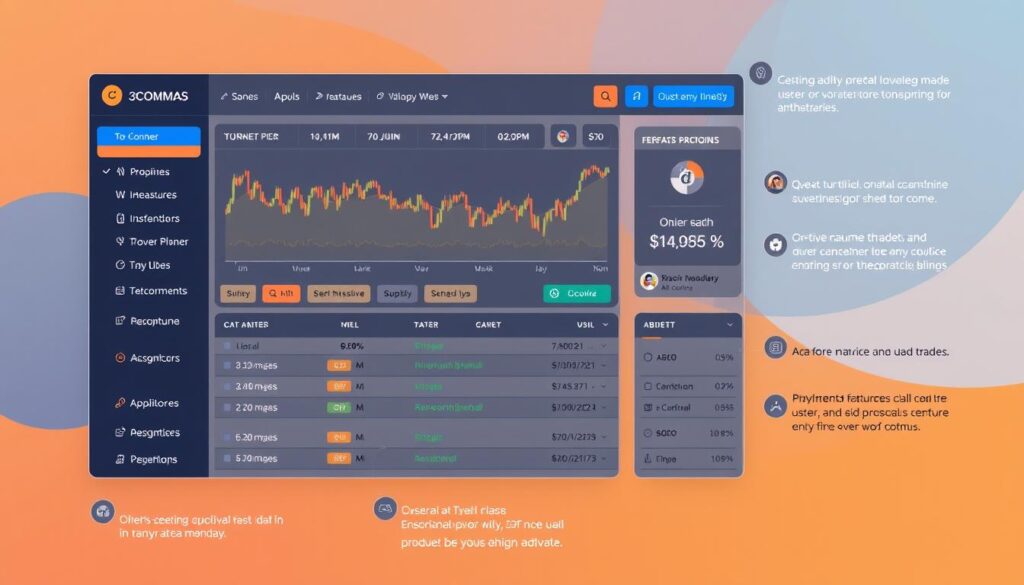

3Commas

Overview

3Commas stands out for its user-friendly interface and robust suite of features, making it suitable for both beginners and experienced traders. It offers a variety of trading bots, including DCA, grid, and options bots.

Key Features

One of its standout features is the SmartTrade terminal, which allows users to execute trades with advanced order types and track performance across multiple exchanges. 3Commas integrates with over 20 major exchanges, ensuring broad compatibility and flexibility.

Pricing Plans

The platform’s pricing plans range from $49/month for the Pro plan to $79/month for the Expert plan, offering scalable solutions for traders at different experience levels.

Pros and Cons

3Commas is praised for its intuitive interface and versatile trading strategies. However, the pricing may be a consideration for some users, particularly those on a tight budget.

Cryptohopper

Overview

Cryptohopper distinguishes itself with its cloud-based architecture, eliminating the need for users to keep their computers running 24/7. It offers comprehensive features, including strategy backtesting and a marketplace for trading strategies.

Key Features

The platform supports 16 major exchanges and provides scalable solutions for traders at different experience levels, with pricing plans ranging from free trials to the Hero Plan at $107.50/month.

Pricing Plans

Cryptohopper’s pricing is competitive, with options to suit various trading needs and budgets.

Pros and Cons

Cryptohopper is lauded for its cloud-based functionality and extensive feature set. Some users may find the array of features overwhelming at first, but the platform offers resources to help navigate its capabilities.

Bitsgap

Overview

Bitsgap offers some of the most sophisticated AI-driven trading algorithms in 2025, with its grid bot, DCA bot, and COMBO futures bot leveraging advanced pattern recognition to optimize trading across over 25 integrated exchanges.

Key Features

The platform’s advanced algorithms and integration with multiple exchanges make it a powerful tool for traders seeking to maximize their trading potential.

Pricing Plans

Bitsgap’s pricing plans are designed to accommodate traders with varying levels of experience and trading volumes.

Pros and Cons

Bitsgap is recognized for its sophisticated trading algorithms and broad exchange compatibility. As with any advanced trading platform, there is a learning curve, but the potential benefits are substantial.

Advanced AI Trading Platforms for Serious Investors

As we dive into 2025, serious cryptocurrency investors are turning to advanced AI trading platforms to gain a competitive edge.

These platforms offer sophisticated features that go beyond basic automation, providing users with powerful tools to manage risk and optimize performance.

TradeSanta

Overview

TradeSanta is a user-friendly AI trading platform that supports both long and short strategies, making it suitable for a wide range of trading objectives.

It integrates with major exchanges such as Bybit, Binance, HTX, and HitBTC, offering users diverse trading options.

Key Features

TradeSanta’s key features include a variety of trading bots, comprehensive backtesting tools, and trailing stop-loss functionality.

These features enable users to automate their trading strategies based on technical indicators and manage risk effectively.

Pricing Plans

TradeSanta offers several pricing plans, ranging from $18/month (Basic) to $45/month (Maximum) when paid annually.

This tiered structure allows users to choose a plan that aligns with their trading needs and budget.

Pros and Cons

The platform’s pros include its streamlined user experience and robust feature set.

However, some users may find the pricing plans to be on the higher side, especially if they are just starting out with AI trading.

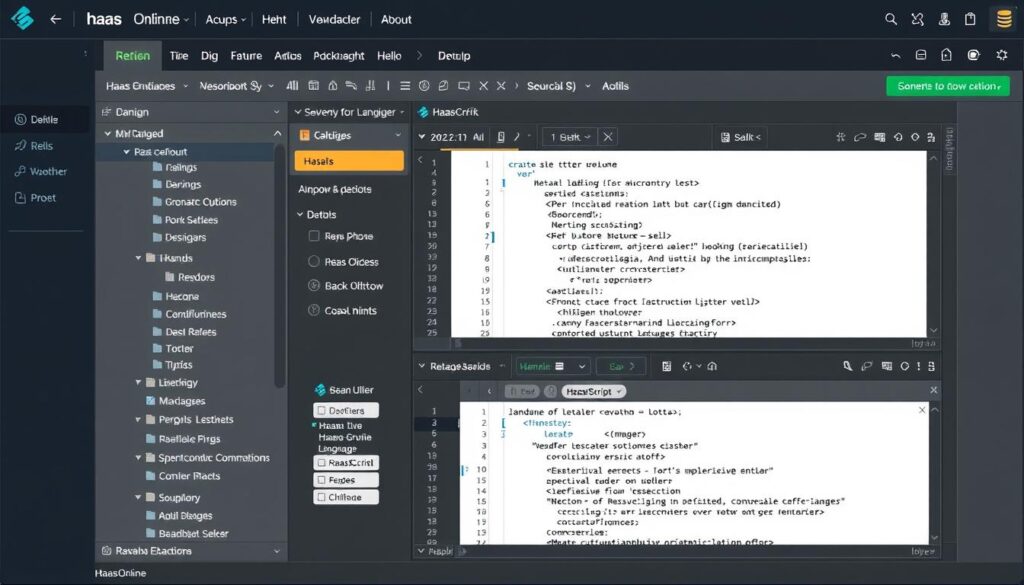

HaasOnline

Overview

HaasOnline represents the cutting edge of AI trading technology in 2025, featuring the proprietary HaasScript language.

This allows users to create highly customized trading algorithms tailored to specific market conditions.

Key Features

The platform’s key features include a visual editor that makes complex strategy development accessible to users without coding experience.

HaasOnline also offers superior risk management tools and higher-performance algorithms.

Pricing Plans

While specific pricing details for HaasOnline are not publicly disclosed, the platform is known for offering flexible plans to accommodate different user needs.

Pros and Cons

HaasOnline’s pros include its advanced customization options and high-performance algorithms.

A potential con is the steep learning curve associated with mastering HaasScript and fully leveraging the platform’s capabilities.

Most Promising AI-Integrated Altcoins of 2025

The convergence of artificial intelligence and cryptocurrency is giving rise to a new generation of altcoins that are poised to revolutionize the market. As we explore the top AI-integrated altcoins of 2025, it’s clear that these projects are not only innovative but also have significant potential for growth.

Bittensor (TAO)

Technology Overview

Bittensor (TAO) is creating a decentralized marketplace for machine intelligence, where AI models compete and are rewarded based on their effectiveness. This platform utilizes a unique peer evaluation system to ensure the quality of AI models.

Use Cases

The TAO token serves as the economic backbone of the Bittensor ecosystem, incentivizing honest assessment and rewarding efficient models. This has attracted institutional interest from entities like Digital Currency Group.

Market Performance

Bittensor has shown promising market performance, with its innovative approach to decentralized AI drawing significant attention.

Investment Potential

With its strong technological foundation and growing adoption, Bittensor presents a compelling investment opportunity in the AI-integrated altcoin space.

Fetch.ai (FET) and the AI Superalliance

Technology Overview

Fetch.ai (FET) is the flagship token of the AI Superalliance, a collaboration between leading blockchain-AI projects like SingularityNET and Ocean Protocol. It aims to advance decentralized Artificial General Intelligence.

Use Cases

FET is used within the AI Superalliance to facilitate the development and deployment of AI solutions, promoting a more decentralized and accessible AI ecosystem.

Market Performance

Fetch.ai has demonstrated robust market performance, driven by the growing interest in decentralized AI and the potential of the AI Superalliance.

Investment Potential

As a key player in the AI Superalliance, Fetch.ai offers significant investment potential, with its technology poised to drive future innovations in the blockchain-AI space.

Internet Computer (ICP)

Technology Overview

Internet Computer (ICP) is a decentralized computing platform that allows AI systems to run directly on-chain, providing the necessary infrastructure for computationally intensive AI operations while maintaining blockchain’s security and transparency.

Use Cases

ICP enables the development of decentralized applications (dApps) that can integrate AI, offering a wide range of use cases from data analysis to complex decision-making processes.

Market Performance

Internet Computer has shown strong market performance, driven by its innovative approach to decentralized computing and its potential to support complex AI applications.

Investment Potential

With its cutting-edge technology and growing ecosystem, Internet Computer presents a promising investment opportunity for those looking to capitalize on the intersection of AI and blockchain.

Numeraire (NMR)

Technology Overview

Numeraire (NMR) addresses the challenge of data overfitting in AI development by creating a tokenized ecosystem where data scientists compete and stake NMR tokens on their predictions.

Use Cases

NMR is used to incentivize data scientists to develop better machine learning models, effectively crowdsourcing improved AI capabilities.

Market Performance

Numeraire has demonstrated steady market performance, driven by its unique approach to improving AI through competitive data science.

Investment Potential

With its innovative model for enhancing AI development, Numeraire offers attractive investment potential, particularly for those interested in the intersection of AI, data science, and blockchain.

Emerging AI Agent Tokens to Watch

As we dive into the world of AI agent tokens, we’re witnessing a revolutionary shift in how blockchain technology is being utilized. These innovative tokens are not just enhancing existing blockchain capabilities but are creating entirely new paradigms for artificial intelligence deployment and monetization.

Virtuals Protocol (VIRTUAL)

Technology Overview

Virtuals Protocol is a decentralized platform that enables AI enthusiasts to create and monetize AI agents across various blockchain ecosystems. Its innovative GAME framework allows for autonomous decision-making capabilities.

Use Cases

The platform’s co-ownership model revolutionizes collaborative AI development, enabling developers to share revenue generated through application integrations and inference fees.

Market Performance

The VIRTUAL token has experienced remarkable growth, with an 850% increase in recent months, demonstrating the market’s confidence in the project’s potential.

Investment Potential

With its pioneering approach to AI agent creation and tokenization, Virtuals Protocol presents a compelling investment opportunity in the burgeoning AI blockchain space.

AI16Z

Technology Overview

AI16Z represents a groundbreaking experiment in decentralized autonomous organizations, featuring the first DAO led by an autonomous AI agent operating on the Solana blockchain.

Use Cases

The project’s governance token serves dual purposes, facilitating decision-making participation and utility within the ecosystem.

Market Performance

With a fixed supply of 1.1 billion tokens and attractive staking rewards, AI16Z has achieved a market capitalization of $2 billion.

Investment Potential

AI16Z’s innovative approach to DAO governance and its robust market performance make it an attractive investment opportunity in the AI-driven blockchain sector.

OriginTrail (TRAC)

Technology Overview

OriginTrail has established itself as a leader in creating decentralized knowledge graphs that enable verifiable data networks.

Use Cases

The TRAC token serves as the core utility for publishing and retrieving data on the OriginTrail Decentralized Network.

Market Performance

OriginTrail’s innovative solution has positioned it as a key player in the Web3 ecosystem.

Investment Potential

With its strong use case and growing adoption, OriginTrail presents a promising investment opportunity in the AI-integrated blockchain space.

How to Choose the Right AI Trading Strategy for Your Portfolio

As we navigate the complex world of cryptocurrency trading in 2025, choosing the right AI trading strategy becomes increasingly important. With numerous options available, it’s crucial to align your trading strategy with your investment goals and risk tolerance.

Assessing Your Risk Tolerance and Investment Goals

Assessing your risk tolerance and defining clear investment goals are foundational steps in selecting the right AI trading strategy. Investors should consider whether they are comfortable with high-volatility strategies or prefer more conservative approaches. For instance, if you’re focused on long-term gains, you might opt for a strategy that prioritizes steady growth over short-term profits.

We recommend evaluating your financial objectives and risk appetite to guide your choice of AI trading strategy. This self-assessment will help you choose a strategy that not only aligns with your goals but also matches your comfort level with market fluctuations.

Matching Trading Strategies to Market Conditions

Different market conditions necessitate different AI trading strategies. For example, during bull markets, momentum-based strategies may be more effective, while bear markets might require mean-reversion or hedging strategies to protect capital.

The best crypto trading strategies in 2025 incorporate adaptive AI that can recognize changing market conditions and adjust parameters accordingly. Consider diversifying your approach by implementing multiple AI strategies that excel under various market scenarios, thereby creating a more resilient portfolio. For more insights on the best crypto AI trading bots, you can visit Coin Bureau’s analysis.

| Market Condition | Recommended AI Strategy | Primary Objective |

|---|---|---|

| Bull Market | Momentum-based | Maximize Gains |

| Bear Market | Mean-Reversion or Hedging | Protect Capital |

| High Volatility | Adaptive AI | Optimize Performance |

Security Considerations for AI-Powered Crypto Trading

With the rise of AI in cryptocurrency trading, protecting your assets has become more critical than ever. As we explore the potential of AI-powered trading strategies, it’s essential to address the unique security challenges that come with automated trading environments.

Protecting Your Assets in Automated Trading Environments

To safeguard your investments, it’s crucial to implement robust security measures. We strongly recommend using API key restrictions that limit trading bots to execution-only permissions without withdrawal capabilities. Additionally, two-factor authentication (2FA) should be mandatory for all trading platform access points.

- Implement comprehensive security protocols to protect your assets from potential breaches.

- Assess the security track record, insurance policies, and cold storage practices of trading platforms.

Evaluating the Security Features of Trading Platforms

When choosing a trading platform, consider the risks associated with third-party integrations and data sharing. Regular security audits of both the trading platforms and AI algorithms are essential to identify potential weaknesses.

| Security Feature | Description | Importance Level |

|---|---|---|

| Two-Factor Authentication (2FA) | Adds an extra layer of security beyond password protection | High |

| API Key Restrictions | Limits trading bots to execution-only permissions | High |

| Cold Storage Practices | Protects funds not actively being traded | Medium |

Conclusion: The Future of AI in Cryptocurrency Trading

Cryptocurrency trading is undergoing a paradigm shift with the integration of artificial intelligence, setting the stage for a new era in financial markets. The year 2025 is just the beginning of this technological revolution, where AI-powered trading strategies are making sophisticated techniques accessible to retail investors while providing institutional-grade tools for professionals.

We’ve seen how the most successful traders will be those who effectively leverage AI capabilities while maintaining a strong understanding of market fundamentals and risk management principles. As blockchain technology and artificial intelligence continue to evolve together, we anticipate more powerful trading tools that can process complex data sets and execute strategies with greater precision.

The best crypto trading approaches in 2025 will combine human oversight with AI execution, creating a powerful partnership that maximizes opportunities while maintaining safeguards. At CoWrit Technologies Inc, we’re committed to helping our clients navigate this exciting frontier where cutting-edge technology meets financial innovation.

About CoWrit Technologies Inc

CoWrit Technologies Inc is at the forefront of AI innovation, providing transformative solutions for businesses. We specialize in AI generative applications and prompt engineering, powering next-generation digital solutions.

Our comprehensive services include professional content writing, website design, and digital marketing strategies, helping our users maximize their digital presence. To explore how we can transform your digital asset strategy, connect with us via WhatsApp at +44-7822010953.